The Ultimate Guide to Forex Online Trading Platforms

Forex trading has witnessed exponential growth in popularity, with countless individuals eager to harness the power of currency trading for financial gain. The success of trading largely depends on the platform you choose. Platforms like forex online trading platform https://trader-maroc.com/ provide a range of tools and functionalities that can enhance your trading experience, but understanding how to navigate these platforms effectively is key for any trader, whether novice or expert.

What is a Forex Online Trading Platform?

A Forex online trading platform is software used to facilitate online trading in the forex market. This includes buying and selling currency pairs, executing trades, and managing accounts across multiple currency pairs. The platform serves as a gateway for traders to access the foreign exchange market, providing essential tools necessary for conducting trades, such as analytical tools, charts, and news feeds.

Key Features of Forex Online Trading Platforms

When searching for a Forex trading platform, various features must be considered to ensure a smooth and efficient trading experience. Below are some of the important features to look out for:

1. User Interface

The user interface (UI) is the first interaction a trader has with the platform. An intuitive and user-friendly interface is crucial for both novice and experienced traders. It should allow easy navigation through different functionalities such as placing orders, accessing trading history, and viewing charts.

2. Trading Tools

Effective trading tools enhance a trader’s decision-making process. Key tools include:

- Technical Indicators: Such as Moving Averages, Bollinger Bands, and RSI to analyze market trends.

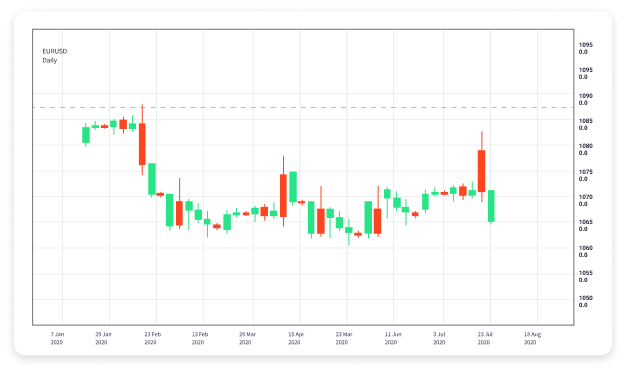

- Charting Software: Allows traders to visualize currency movements and patterns.

- Economic Calendar: Helps traders keep track of significant economic events that may impact currency values.

3. Security Features

Security is paramount as traders invest real money. Reliable platforms utilize encryption technologies and provide two-factor authentication to safeguard the accounts against unauthorized access and fraud.

4. Accessibility

Modern traders value accessibility. The platform should be available on multiple devices, including desktops, tablets, and smartphones. This allows for trading on-the-go and monitoring trades at any time.

5. Customer Support

Efficient customer support can make a significant difference in trading experiences. Look for platforms that offer 24/7 support through various channels, including live chat, email, and telephone.

Types of Forex Online Trading Platforms

There are generally two main types of Forex trading platforms:

1. Web-Based Platforms

These platforms run directly from a web browser, meaning you do not have to download any software. They are accessible from anywhere with an internet connection. Web-based platforms provide convenience and ease of access but may have limitations on certain functionalities compared to downloaded software.

2. Downloadable Platforms

Downloadable platforms require installation on your computer. They typically offer better performance, advanced charting tools, and more comprehensive trading functionalities. However, they may not be as convenient for traders who prefer to trade from multiple devices.

How to Choose the Right Forex Online Trading Platform

Choosing the right Forex trading platform is critical for successful trading. Here are some factors to consider:

1. Regulation

Ensure that the platform is regulated by a reputable authority. Regulatory bodies impose strict standards and guidelines to protect traders, promoting fair and transparent trading practices.

2. Fee Structure

Different platforms have varying fee structures. It’s essential to understand the spread, commissions, and any other hidden fees that may affect your overall profitability.

3. Asset Variety

Choose a platform that provides access to a diverse range of markets and currency pairs. This allows for broader trading opportunities and the ability to diversify your trading portfolio.

4. Trading Conditions

Examine the trading conditions offered by the platform, including leverage, margin requirements, and execution speed. Only choose a platform that meets your trading strategy and risk tolerance.

Benefits of Using an Online Forex Trading Platform

Utilizing an online Forex trading platform provides several advantages:

1. Flexibility

Online trading platforms allow traders to execute trades from virtually anywhere. Trading can be done from home, the office, or even while traveling.

2. Lower Transaction Costs

Online platforms often have lower transaction costs compared to traditional trading methods, thus maximizing potential profits.

3. Access to Information

These platforms provide real-time market data, charts, and analysis tools, allowing traders to make informed decisions quickly.

4. Automation

Many platforms offer automated trading features, which allow traders to set parameters for trades to execute automatically based on defined criteria.

Conclusion

The world of Forex trading can be both exciting and challenging, but with the right online trading platform, traders can enhance their chances of success. Take the time to research and select a platform that suits your trading style, requirements, and preferences. Whether you’re just starting or looking to switch to a new platform, making an informed decision can lead to a more prosperous trading experience.